Don't miss our holiday offer - up to 50% OFF!

Variable Overhead Efficiency Variance Definition, Formula, Example, Calculation, Explanation

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Variable Overhead Rate Variance Example

Again, this variance isfavorable because working fewer hours than expected shouldresult in lower variable manufacturing overhead costs. Variable Overhead Efficiency Variance is calculated to quantify the effect of a change in manufacturing efficiency on variable production overheads. As in the case of variable overhead spending variance, the overhead rate may be expressed in terms of labor hours or machine rent receipt templates hours (or both) depending on the degree of automation of production processes. The hourly rate in this formula includes such indirect labor costs as shop foreman and security. If actual labor hours are less than the budgeted or standard amount, the variable overhead efficiency variance is favorable; if actual labor hours are more than the budgeted or standard amount, the variance is unfavorable.

Formula to Calculate Fixed Overhead Variance

This variance is unfavorable for Jerry’s Ice Cream becauseactual costs of $100,000 are higher than expected costs of$94,500. This example provides an opportunity to practice calculating the overhead variances that have been analyzed up to this point. By contrast, efficiency variance measures efficiency in the use of the factory (e.g., machine hours employed in costing overheads to the products). Hours refers to the number of machine hours or labor hours incurred in the production of output during a period. Variable overhead efficiency variance refers to the difference between the true time it takes to manufacture a product and the time budgeted for it, as well as the impact of that difference.

What is a variable overhead variance?

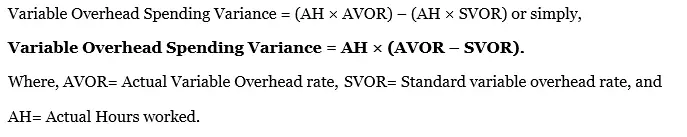

The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance. This formula takes the difference between the standard variable overhead rate and the actual variable overhead rate, and multiplies this by the actual quantity of units of variable overhead used. Figure 10.61 shows the connection between the variable overhead rate variance and variable overhead efficiency variance to total variable overhead cost variance.

Formulas to Calculate Overhead Variances

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Recall from Figure 10.1 that the variable overhead standard ratefor Jerry’s is $5 per direct labor hour and the standard directlabor hours is 0.10 per unit.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- Consequently this variance would be posted as a credit to the variable overhead efficiency variance account.

- By using standard cost against both the actual and expected quantity, we get the variance in dollars that is attributed to quantity only.

The forensic accountant who investigated thefraud identified several suspicious transactions, all of which werecharged to the manufacturing overhead account. Suppose Connie’s Candy budgets capacity of production at \(100\%\) and determines expected overhead at this capacity. Connie’s Candy also wants to understand what overhead cost outcomes will be at \(90\%\) capacity and \(110\%\) capacity. Total overhead cost variance can be subdivided into budget or spending variance and efficiency variance.

By using standard cost against both the actual and expected quantity, we get the variance in dollars that is attributed to quantity only. Variable overhead spending variance is essentially the difference between the actual cost of variable production overheads versus what they should have cost given the output during a period. If however, the balances are significant in relation to the size of the business, then we need to analyze the variable overhead variances between the inventory accounts (work in process, and finished goods) and the cost of goods sold account. Since Jerry’s uses direct labor hours as the activitybase, the possible explanations for this variance are linked toefficiencies or inefficiencies in the use of direct labor. On the other hand when actual hours exceed standard hours allowed, the variance is negative and unfavorable implying that production process was inefficient.

The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Recall from Figure 10.1 that the variable overhead standard ratefor Jerry’s is $5 per direct labor hour and the standard directlabor hours is 0.10 per unit. Figure 10.8 shows how to calculatethe variable overhead spending and efficiency variances given theactual results and standards information. Review this figurecarefully before moving on to the next section where thesecalculations are explained in detail.

Variable Overhead Efficiency Variance is the measure of impact on the standard variable overheads due to the difference between standard number of manufacturing hours and the actual hours worked during the period. Variable overheads are those costs which vary in response to the level of production output but which cannot be attributed to individual units of production. For example, an item might be manufactured by equipment which cuts and shapes a sheet of plastic.